Wondering how the currency exchange rate works? You’re not alone. The currency exchange rate can be a complex topic, but we’ve put together this guide to explain how they work in simple terms.

We’ll cover everything from how the exchange rate is determined to how you can capitalize on it. By the end of this guide, you’ll have a clear understanding of how currency exchange rates work and how they can impact your business or travel plans.

See more: 4 Reasons Why You Should Choose Fintech Companies to Transfer Money Instead of Traditional Methods

What Is Currency Exchange?

Currency exchange is the process of converting one currency into another. It is typically done through banks or other financial institutions and involves exchanging one currency for another at an agreed-upon rate.

The currency exchange rate can be either fixed or floating and is determined by a number of factors, including inflation, interest rates, and political stability.

How Is The Currency Exchange Rate Determined?

There are a number of factors that contribute to the determination of currency exchange rates. Some of the more important ones include:

- The balance of trade between two countries. If a country exports more than it imports, its currency will gain in value relative to the currency of the other country.

- The interest rate differential between two countries. If one country has a higher interest rate than another, investors will want to buy the former and sell the latter, causing the first currency's value to rise.

- The level of inflation in two countries. If one country has a greater inflation rate than another, its currency will decline in relation to the other's currency.

- Political stability. In general, investors feel more confident investing in countries with stable governments and political systems, which leads to increased demand for that currencies and, as a result, a rise in their values.

The Difference between Buying and Selling Exchange Rates

When you exchange currencies, you essentially buy one and sell another. The rate you've been offered is the amount of foreign money you'll receive in exchange for one unit of your own currency. The supply and demand market decides the exchange rate.

The "buy" rate is the price at which money exchangers will buy foreign currency from you. The "sell" rate is the price at which they will sell you foreign currency. Obviously, if you wish your exchange rate to be good, you should buy it at the lower "buy" rate and sell it at the higher "sell" rate.

What Factors Can Affect Currency Exchange Rates?

Currency exchange rates are influenced by a wide range of factors. The most important factor is the economic stability of the country from which the currency you are converted.

The most important factor affecting a country's currency exchange rate is its economic health. If a country's economy is doing well, its currency will rise; if the economy is doing poorly, the currency will fall.

Other crucial factors include the interest rate established by the country's central bank, the country's level of inflation, and the country's political stability.

How to Find the Best Currency Exchange Rate

When it comes to finding the best currency exchange rate, there are a few things you need to take into account. The first is the type of currency you're looking to exchange. Some currencies are worth more than others, so you'll want to make sure you're getting the most bang for your buck.

Another factor to evaluate is the present market conditions. Currency values are likely to fluctuate often in an uncertain market. In this instance, it may be recommended that you wait for a more stable period before exchanging your money.

Finally, you'll also want to compare rates between different currency exchange providers. This way, you can be sure you're getting the best deal possible.

How Can You Get The Best Deal When Exchanging Currency?

There are a few things you can do to get the best deal when exchanging currency:

- Shop around for the best exchange rate. Compare rates between banks, credit unions, and online currency exchange services.

- Avoid currency exchange kiosks at airports or other tourist areas, which typically have higher rates.

- If you're traveling abroad, use your debit card or credit card to withdraw cash from ATMs instead of exchanging currency at a bank or airport kiosk. You'll likely get a better exchange rate and avoid fees charged by some money changers.

- Consider using a service that allows you to lock in an exchange rate in advance so you know how much foreign currency you'll get for your money regardless of fluctuations in the market such as EzyTravel.

Are There Any Risks To Using An Online Currency Exchange?

When it comes to sending money internationally, there are a few things you should take into consideration. The first is that the exchange rate may not be favorable at the time you make your transaction. The second is that the online currency exchange may not be reputable or trustworthy. Finally, there is always the risk that your personal and financial information could be compromised if you use an online currency exchange.

To avoid any potential problems, it is always best to do your research ahead of time. Make sure you know the current exchange rate and only use a reputable online currency exchange. By taking these precautions, you can help ensure a smooth and successful transaction.

Of course, you can use online currency exchanges to help mitigate some of this risk. These services allow you to lock in an exchange rate for a specific period of time, which can protect you from sudden changes in the market. However, even when using an online currency exchange, you should be aware that there is still some risk involved.

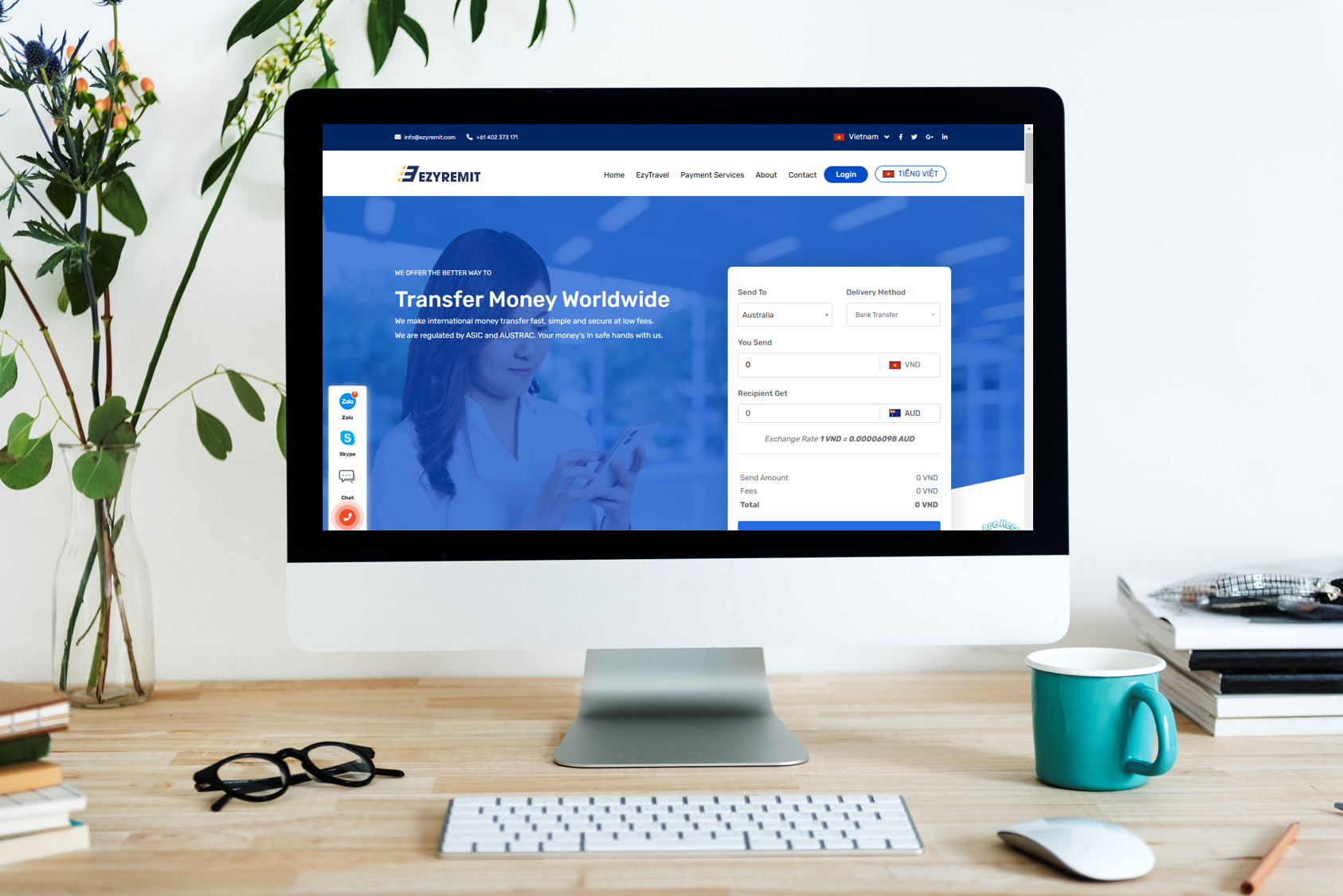

Use EzyRemit for Better Exchange Rate

When looking to get the best exchange rate, it is important to compare rates from different sources. However, not all exchange rate providers are created equal.

EzyRemit is a leading remittance service provider that offers excellent rates and low fees. When you use EzyRemit for your money transfer, you can be confident that you are getting a great exchange rate.

In addition, EzyRemit offers a number of other benefits, including:

- Fast and easy online transactions

- A wide range of currencies is available

- 24/7 customer support

When you sign up for our EzyTravel service, you'll be able to lock in an exchange rate for your upcoming trip. This means that you'll know exactly how much money you'll have to spend while you're abroad, and won't have to worry about fluctuations in the currency markets. With EzyTravel, you can rest assured that your finances are taken care of before you even leave home.